Breitbart Business Digest: The Liquid Gold Fueling Trump’s Golden Age of America

President Trump’s first day executive orders make it clear that the administration plans to unshackle American energy production.

President Trump’s first day executive orders make it clear that the administration plans to unshackle American energy production.

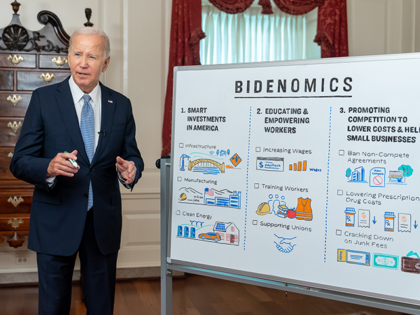

America may be just about done with Joe Biden, but the malevolent economic legacy of his presidency is not done with us.

The December CPI report is a sign that the Fed’s fight against inflation has stalled.

A resilient labor market, the improving outlook among small businesses, and persistent inflation pressures are signals that the Fed’s September and October rate cuts may have been premature.

The Federal Reserve’s rate-cutting cycle has very likely come to an end—although it may take Fed officials several months to figure this out.

The Federal Reserve’s reputation may not be burning down as rapidly as Los Angeles, but the outcome is likely to be the same: rubble, ashes, recriminations, and an expensive rebuilding.

It is not just the bond market that is having doubts about the stance of monetary policy. Federal Reserve officials are also seeing the light.

The great clash between Donald Trump and the Federal Reserve may not happen after all.

Greenland is one of those rare geopolitical assets that might actually be worth it to buy. So, how much would it cost?

The evidence keeps mounting that the election of Donald Trump to a second presidential term is already causing an economic acceleration.

Richard A. Easterlin, a trailblazing economist whose insights reshaped our the postwar baby boom, died at his home in Pasadena, California, on December 16.

Americans are strolling into the new year with a bit more spring in their steps, thanks to the imminent return of Donald Trump to the White House and the long-awaited end of the Biden-Harris era.

Biden’s dismissal of inflation concerns wasn’t just a verbal misstep. It was a bizarre signal that Biden wasn’t in touch with the policy discussion going on across the country.

The U.S. economy will barely notice if the federal government needs to shut down because funding authorization runs out at 12:01 a.m. on Saturday, December 21.

President-elect Donald Trump’s recent support for the dockworkers of the International Longshoremen’s Association (ILA) should be viewed through the lens of dealmaking.

A super-majority of Americans, across racial and ethnic groups, think the stock market is important, according to the latest survey by YouGov for the Economist.

The Federal Reserve is about to triple down on its September rate cut mistake by reducing its benchmark for a third consecutive time next week.

Trump’s tariffs, far from being the Grinch, may well be the unseen Santa, bringing the gift of a healthier trading system to the good little boys and girls of the world.

The University of Michigan’s index of consumer sentiment rose in early December to its best reading since April, boosted by more positive views among Republicans and independents following the election of Donald Trump.

Like so much economic analysis from the establishment, the Fed study on tariffs arrives with breathless findings of calamity, but it doesn’t stand up to scrutiny.

The election of Donald Trump has already sparked a turnaround in sentiment among consumers and businesses, with the vibecession falling away and the rosy-fingered dawn of a new golden age spreading from sea to shining sea.

Federal Reserve officials appear poised to repeat the mistake of September and November by cutting interest rates again when the economic data clearly calls for a pause.

The acceleration of inflation since the Federal Reserve cut interest rates in September suggests that the move was a mistake.

Donald Trump has been very clear that he plans to use tariffs as a tool to pursue U.S. geopolitical interests.

In Scott Bessent, Donald Trump has chosen a capable lieutenant to ensure his economic policies can be revived after the inflation-ridden interregnum of the Biden administration.

The numbers don’t lie. Hope and confidence are back in style, and the economy is starting to feel it.

Donald Trump and JD Vance saw a surge in their favorability rating among voters aged 18 to 29 following their victory on Election Day.

The woes of Target hold a message for anyone who thinks that Walmart will raise its prices in reaction to tariffs President-elect Donald Trump is likely to raise on imports from China.

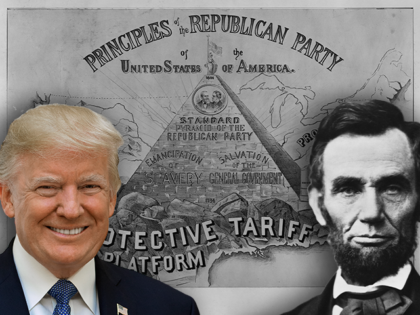

The Republican Party has returned to its traditional stance in favor of tariffs and economic nationalism.

Now that the election is safely in the past, we are finally getting some clarity about the economically damaging inflation that crippled Biden’s presidency and swept the legs out from Kamala Harris’s attempt to become the 47 president.

A question we get asked a lot about is how the Federal Reserve is likely to react to President-elect Donald Trump’s tariffs. The short answer is that the Fed is likely to ignore them.

One of the reasons Democrats were caught off guard by the strength of support for Donald Trump across America is that they underestimated the importance of inflation and economic conditions to voters.

Donald Trump and the Republicans have a mandate for new economic policy.

Donald Trump is not going to try to remove Jerome Powell as the head of the Federal Reserve or control monetary policy from the White House.

The conventional wisdom on Wall Street has long been that a sweep by Republicans in the election would be inflationary. Here’s why that’s probably wrong.

There are four major policy changes that Donald Trump can embrace to revitalize the U.S. economy.

The presidential election was in significant part an economic referendum in which voters chose Trump and his economic policies.

On the eve of the presidential election, Americans still have a dour assessment of the economy and are far more likely to say they trust Donald Trump to manage it than Kamala Harris.

The economy delivered some rough justice to the campaign of Kamala Harris on Friday in the form of the monthly jobs report.

The latest economic data suggests that the Federal Reserve should halt any further rate cuts.